Biopharmaceutical Market Size, Share, Trends and Forecast by Indication, Class, and Region, 2025-2033

Biopharmaceutical Market Size and Share:

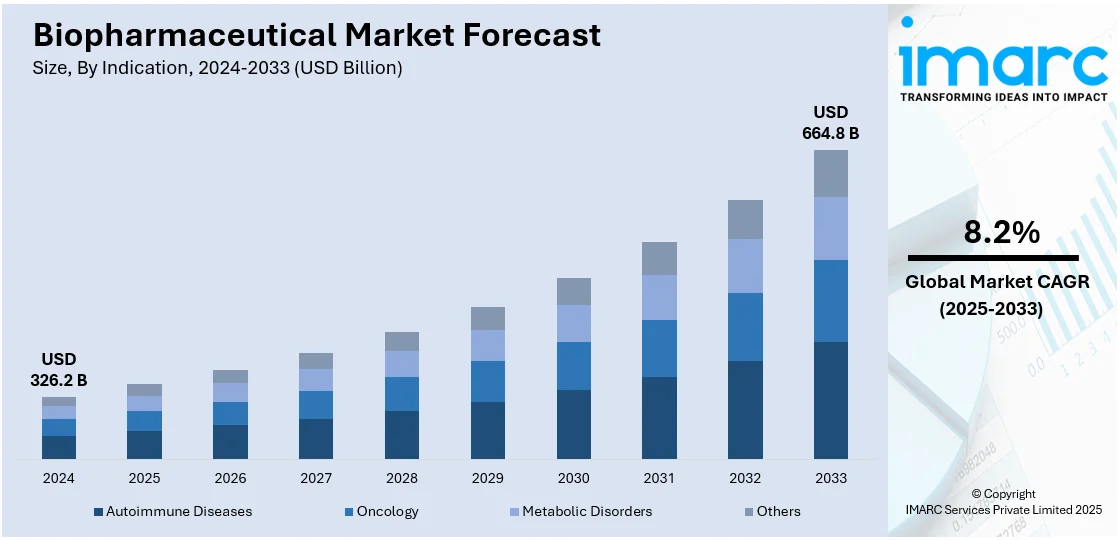

The global biopharmaceutical market size was valued at USD 326.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 664.8 Billion by 2033, exhibiting a CAGR of 8.2% during 2025-2033. North America currently dominates the market, holding a significant market share of 45.0% in 2024. The market is propelled by the growing incidence of chronic and rare diseases, advances in technologies like gene editing, monoclonal antibodies, and mRNA platforms and committed investment from private and public sources fueling research and development activities. Positive regulatory climates in most nations providing incentives for quick approvals and access to the market for new drugs, along with increasing healthcare infrastructure and awareness in developing economies to extend the sales reach of biopharmaceutical products globally, are further increasing the biopharmaceutical market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 326.2 Billion |

| Market Forecast in 2033 | USD 664.8 Billion |

| Market Growth Rate 2025-2033 | 8.2% |

The biopharmaceutical industry is being propelled by the confluence of scientific developments, growing healthcare demands, and facilitative regulatory regimes. A significant driver among them is the growth in incidence rates of chronic and complex conditions, including cancer, autoimmune diseases, and orphan diseases, that necessitate new and targeted treatments. The increasing emphasis on personalized medicine and the potential to create therapies targeted to individual genetic profiles are also driving biopharmaceutical R&D. Moreover, innovation in biotechnology, such as gene editing, mRNA technologies, and cell therapy, is driving breakthroughs which were not possible before. Governments and healthcare organizations globally are also heavily investing in biopharmaceutical innovation through funding, tax credits, and expedited approval processes. The aging population worldwide is another major driver, leading to increased need for more efficient and long-term treatments. These forces together are creating a strong and competitive environment in the biopharmaceutical sector, with innovation being at the center, which helps in fueling the biopharmaceutical market growth.

The United States stands out as a key market disruptor, driven by its unparalleled blend of innovation, investment, and infrastructure. It hosts numerous of the world's top biotech and pharmaceutical firms, and the US leads through ongoing innovation in research and development, especially in fields such as gene therapy, mRNA technologies, and immuno-oncology. The availability of renowned research centers, strong venture capital backing, and a well-defined regulatory environment allows for swift scientific advancement. The US Food and Drug Administration (FDA) is significant in providing fast-track approval options and encouraging innovation while not jeopardizing safety. Additionally, collaboration among biotech start-ups, academia, and international pharma majors facilitates large-scale commercialization of innovative treatments. With elevated healthcare expenditures and early uptake of new medicines, the US drives pricing strategies, trial designs, and international regulatory directions, making US the leading disruptor of the future of biopharmaceuticals.

Biopharmaceutical Market Trends

Increased Prevalence of Chronic Diseases

The global rise in chronic diseases such as cancer, diabetes, cardiovascular diseases, and autoimmune disorders is a significant driver of the biopharmaceutical market. Chronic diseases require prolonged treatment and often rely on biopharmaceuticals for management and therapy, driving demand for these products. For instance, cancer has become a critical area for biopharmaceuticals with the development of targeted therapies that provide more effective and personalized treatment options compared to traditional chemotherapeutics. As reported by the World Health Organization, cancer ranks as the second highest cause of death worldwide, with around 20 Million new cancer cases and 9.7 Million fatalities in 2022. The rising worldwide cancer rates require continuous advancement and market introduction of biopharmaceuticals, including monoclonal antibodies and cancer vaccines, which typically prove to be more effective and have reduced side effects compared to traditional therapies. This need results in significant investments in research and development by leading pharmaceutical firms and an increase in both public and private funding focused on addressing these chronic illnesses.

Significant Advancements in Biopharmaceutical

Biopharmaceutical advancements are pivotal in the evolution and growth of the market. These advancements include genetic engineering, high-throughput screening technologies, and next-generation sequencing, among others. These technologies enhance the ability of researchers to understand diseases at a molecular level and to develop drugs that can target these diseases more effectively and safely, further shaping a positive biopharmaceutical market outlook. According to the IMARC Group, the global genomics market reached USD 38.4 Billion in 2024 and is expected to reach USD 113.3 Billion by 2033, exhibiting a growth rate (CAGR) of 12.77% during 2025-2033. This growth is indicative of the critical role genomics plays in drug discovery and personalized medicine, both of which are essential to the development of biopharmaceuticals. Improved biotechnological tools speed up the drug discovery process and also increase the success rate of the drugs developed, thereby attracting more investments and research into this sector.

Rising Government Support and Healthcare Expenditure

Government initiatives and healthcare spending are crucial in propelling the market according to the biopharmaceutical market forecast. Many governments worldwide are increasing their healthcare budgets, which includes funding for the research and development of biopharmaceuticals. For instance, expenditure on healthcare in the United States increased by 7.5% in 2023, reaching USD 4.9 Trillion, according to the Centers for Medicare and Medicaid Services (CMS). Overall, healthcare expenditure accounted for 17.6% of the GDP of the country. This is particularly evident in developed countries, where there is a strategic focus on sustaining innovation to maintain a competitive edge in the global healthcare market. For instance, India spends almost $ 1.4 billion on biomedical research, according to the HINDUSTAN TIMES. This substantial investment in health research reflects the support of the government for the biopharmaceutical industry, providing the necessary financial resources to fuel research, development, and the adoption of advanced therapies. Such government backing enhances the development capabilities of biopharmaceutical firms and helps in the faster commercialization of new drugs, ensuring that these innovations reach the market and become accessible to patients in need, thus creating a positive biopharmaceutical market outlook.

Biopharmaceutical Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global biopharmaceutical market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on indication and class.

Analysis by Indication:

- Autoimmune Diseases

- Oncology

- Metabolic Disorders

- Others

Autoimmune diseases stand as the largest component in 2024. Autoimmune diseases represent the largest segment in market breakup by indication within the biopharmaceutical sector primarily due to the high prevalence and chronic nature of these conditions, coupled with a significant unmet need for effective and sustainable treatments. Autoimmune diseases, which include conditions such as rheumatoid arthritis, multiple sclerosis, and lupus, affect millions globally, necessitating long-term, often lifelong management. The complexity of these diseases, characterized by the immune system mistakenly attacking the tissues of their own body, demands therapies that are highly specific and capable of modulating immune responses without severe side effects. Biopharmaceuticals, particularly biologics such as monoclonal antibodies and fusion proteins, have been revolutionary in this field. They offer targeted therapies that specifically address underlying immune dysfunctions, leading to better disease management and improved quality of life for patients.

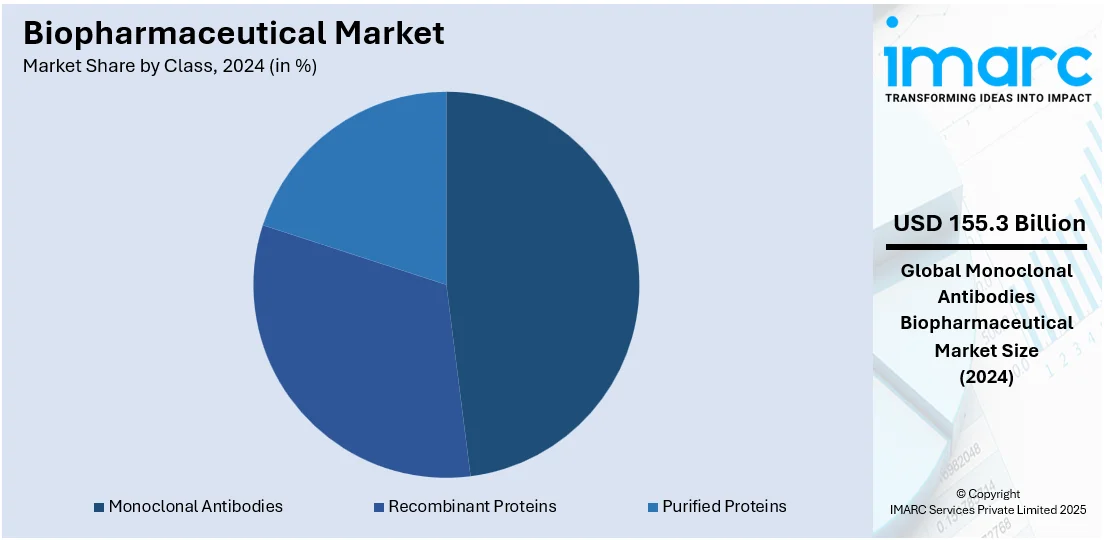

Analysis by Class:

- Recombinant Proteins

- Monoclonal Antibodies

- Purified Proteins

Monoclonal antibodies lead the market with 47.6% of market share in 2024. Monoclonal antibodies dominate the biopharmaceutical market as the largest segment in market breakdown by class due to their highly targeted therapeutic capabilities and broad applicability across various diseases. These antibodies are engineered to bind to specific antigens present on the surface of cells or pathogens, allowing for precise targeting of diseases such as cancer, autoimmune disorders, and infectious diseases. Their ability to be tailored for specific targets enhances their efficacy and minimizes off-target effects, which contributes to their substantial market share. The growing prevalence of chronic diseases and the increasing demand for personalized medicine have further amplified the reliance on monoclonal antibodies, thereby creating a positive biopharmaceutical industry overview.

Regional Analysis:

- North America

- United States

- Canada

- Latin America

- Brazil

- Mexico

- Argentina

- Europe

- Germany

- France

- Italy

- Spain

- United Kingdom

- Russia

- Turkey

- Asia Pacific

- Japan

- China

- Australia

- South Korea

- India

- Indonesia

In 2024, North America accounted for the largest market share of 45.0%. North America is the largest segment in the global biopharmaceutical market primarily due to its well-established healthcare infrastructure, significant research and development investments, and a robust regulatory framework. The United States is home to numerous leading biopharmaceutical companies and research institutions that drive innovation in drug development and biopharmaceutical. The region benefits from substantial public and private funding, which supports extensive R&D activities and the commercialization of advanced therapeutics. Additionally, the high healthcare spending and advanced medical infrastructure of North America ensure that new biopharmaceutical products are rapidly adopted and integrated into clinical practice.

Key Regional Takeaways:

United States Biopharmaceutical Market Analysis

In 2024, the United States accounted for over 91.20% of the biopharmaceutical market in North America. The United States biopharmaceutical market is primarily driven by advancements in biotechnology, particularly in gene and cell therapies, which have opened new avenues for treating previously untreatable conditions, such as certain cancers and genetic disorders. Technologies such as CRISPR-Cas9 and CAR-T cell therapies are at the forefront of this transformation, enabling more targeted and personalized treatments. Additionally, the success of mRNA technology is increasing investment into mRNA-based therapeutics, expanding their application beyond vaccines to include treatments for cancer and rare diseases. The increasing geriatric population in the United States is also contributing to the heightened demand for treatments targeting age-related diseases such as Alzheimer's, osteoporosis, and cardiovascular conditions, as well as chronic diseases such as diabetes and arthritis. According to the American Diabetes Association, 11.6% of the population in the United States suffered from diabetes in 2021, equating to 38.4 million individuals. Out of these, individuals aged 65 years and older accounted for 29.2% of the total, equating to 16.5 million seniors suffering from diabetes, both diagnosed and undiagnosed. This demographic shift is propelling the need for innovative biopharmaceutical solutions to manage long-term health challenges. Other than this, the United States maintains a robust healthcare infrastructure and a favorable regulatory environment, which incentivize the development of treatments for rare diseases.

Asia Pacific Biopharmaceutical Market Analysis

The Asia Pacific biopharmaceutical market is expanding due to a rapidly growing population, an expanding middle class, and increasing healthcare awareness among consumers. Rising prevalence of chronic diseases such as diabetes, cancer, and cardiovascular disorders has heightened the demand for advanced and targeted therapies. Technological advancements in biotechnology and bioscience research, combined with a growing pool of skilled professionals, are further contributing to innovation and product development. Moreover, favorable demographic trends, such as an increasing geriatric population, are intensifying the need for biologics and specialty treatments. According to the United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP), 670 million people in the Asia-Pacific area were 60 years of age or older in 2022. By 2050, this figure is anticipated to increase to 1.3 billion. In addition, the growing acceptance of biologics over conventional medications and the increasing affordability of healthcare are driving industry growth.

Europe Biopharmaceutical Market Analysis

The Europe biopharmaceutical market is experiencing robust growth, fueled by the increasing prevalence of chronic and rare diseases, which is driving the demand for innovative, high-efficacy treatments. According to Eurostat, in 2023, more than 35.0% of the population in the European Union reported suffering from a chronic illness. Rising health awareness among the population has led to earlier diagnosis and increased demand for precision medicine, which relies heavily on biologics and targeted therapies. The growing adoption of digital health technologies, such as AI-driven drug discovery platforms, wearable diagnostics, and real-world data integration, has also significantly expedited research timelines and optimized clinical development. Additionally, strategic collaborations between academic research institutions and pharmaceutical developers have enhanced innovation pipelines, leading to a wider array of biologics reaching clinical trials. Moreover, the expansion of biosimilars, particularly in cost-sensitive markets within Europe, is increasing patient access to biologic treatments while maintaining market growth. The development of advanced manufacturing platforms, such as continuous bioprocessing and single-use technologies, has also improved production efficiency and scalability. Other than this, the diverse patient pool and structured clinical research infrastructure in Europe make it a strategic location for clinical trials, which further supports product development and commercialization. Increasing consumer preference for personalized and minimally invasive treatments is also driving demand for advanced biopharmaceuticals over traditional small-molecule drugs.

Latin America Biopharmaceutical Market Analysis

The Latin America biopharmaceutical market is significantly influenced by the region’s increasing integration into global supply chains, which enhances access to raw materials, technologies, and expertise essential for biologics manufacturing. Improvements in cold chain logistics and storage capabilities are also making it easier to distribute temperature-sensitive biopharmaceutical products across remote and underserved areas, expanding market reach and patient access. For instance, the cold chain logistics market in Brazil is expected to reach USD 5.3 Billion by 2032, growing at a CAGR of 9.23% during 2024-2032, as reported by the IMARC Group. Additionally, the region's expanding healthcare infrastructure and investments in research and development (R&D) are fostering innovation and improving access to biopharmaceutical products. Consumer preferences are also shifting toward higher-quality and more effective treatments, encouraging the adoption of innovative biopharmaceuticals over conventional medicines.

Competitive Landscape:

Major biopharmaceutical companies are driving growth through a variety of strategic efforts, including substantial investments in research and development (R&D), strategic partnerships, and technological advancements. Major biopharmaceutical companies such as Pfizer, Roche, and Novartis are dedicating significant resources to developing innovative therapies and expanding their product portfolios. They are also forming strategic alliances with biopharmaceutical firms, research institutions, and technology companies to accelerate drug discovery and development processes. For instance, partnerships with technology firms are enhancing capabilities in artificial intelligence and data analytics, which streamline drug discovery and improve precision medicine. According to the biopharmaceutical market forecast, these companies are also investing in cutting-edge technologies such as gene and cell therapies to address unmet medical needs and tap into emerging markets.

The report provides a comprehensive analysis of the competitive landscape in the biopharmaceutical market with detailed profiles of all major companies, including:

- Amgen Inc.

- Eli Lilly and Company

- F. Hoffmann-La Roche AG

- Johnson & Johnson

- AbbVie Inc.

- Pfizer Inc.

- Sanofi S.A.

- Merck & Co. Inc.

- Novo Nordisk A/S

- Biogen Inc.

Latest News and Developments:

- May 2025: Singapore-based Nuevocor completed its USD 45 million Series B funding round. This financing will fund an open-label, first-in-human, multi-center, ascending single-dose Phase 1/2 clinical trial of the company’s NVC-001 biopharmaceutical drug in individuals with LMNA DCM. Nuevocor also plans to open a branch in Paris, France, to promote research and development.

- May 2025: The US Food and Drug Administration (FDA) granted IGI, a clinical-stage biotech company that focuses on developing multi-specifics in oncology, Fast Track Status for their biopharmaceutical ISB 2001. An investigational tri-specific antibody therapy called ISB 2001 targets T cells' CD3 and myeloma cells' BCMA and CD38. For the treatment of people with relapsed or refractory multiple myeloma (RRMM) who have received at least three prior lines of therapy, this critical status was awarded.

- April 2025: Merck announced the start of construction of a USD 1 billion biologics center of excellence in Wilmington, Delaware. The 470,000-square-foot facility will feature laboratory, production, and warehousing capabilities, which will facilitate the introduction and commercial manufacturing of next-generation biologics.

- April 2025: Amgen, a biologics manufacturer based in the United States, reported that it is expanding its production facility in Ohio with an estimated investment of USD 900 million. This expansion will reportedly result in the generation of 750 new jobs and total investment of USD 1.4 billion.

- March 2025: Chiesi Group, an Italy-based international biopharmaceutical firm, announced a significant investment in Nerviano, with the establishment of a new manufacturing plant for its medicinal solutions. A 124,000-square-meter industrial complex will be redeveloped with EUR 430 million funding, which will be distributed over 2025 and 2030, to become a global center of innovation and excellence.

- January 2025: Tanvex BioPharma, Inc. successfully acquired Bora Biologics Co., Ltd., a division of Bora Pharmaceuticals. After this merger, Tanvex will operate its CDMO services under the brand name Bora Biologics.

Biopharmaceutical Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Indications Covered | Autoimmune Diseases, Oncology, Metabolic Disorders, Others |

| Classes Covered | Recombinant Proteins, Monoclonal Antibodies, Purified Proteins |

| Regions Covered | North America, Latin America, Europe, Asia Pacific |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, Italy, Spain, United Kingdom, Russia, Turkey, Japan, China, Australia, South Korea, India, Indonesia |

| Companies Covered | AbbVie Inc., Amgen Inc, Biogen Inc., Eli Lilly and Company, F. Hoffmann-La Roche AG, Johnson & Johnson, Merck & Co. Inc., Novo Nordisk A/S, Pfizer Inc., Sanofi S.A etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the biopharmaceutical market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global biopharmaceutical market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the biopharmaceutical industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The biopharmaceutical market was valued at USD 326.2 Billion in 2024.

The biopharmaceutical market is projected to exhibit a CAGR of 8.2% during 2025-2033, reaching a value of USD 664.8 Billion by 2033.

The biopharmaceutical market is driven by rising demand for targeted therapies, increasing prevalence of chronic diseases, and advancements in biotechnology. Personalized medicine, strong R&D investments, and supportive regulatory frameworks further propel growth. Aging populations and global healthcare expansion also contribute to the market’s rapid evolution and innovative breakthroughs.

North America currently dominates the biopharmaceutical market, driven by advanced research infrastructure, strong investment in innovation, and a high prevalence of chronic diseases. Favorable regulatory policies, widespread healthcare access, and early adoption of new therapies support growth. Collaboration between biotech firms and academic institutions further accelerates drug development and commercialization.

Some of the major players in the biopharmaceutical market include AbbVie Inc., Amgen Inc, Biogen Inc., Eli Lilly and Company, F. Hoffmann-La Roche AG, Johnson & Johnson, Merck & Co. Inc., Novo Nordisk A/S, Pfizer Inc., Sanofi S.A, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)